Did Income Tax Go Up In 2025. A number of other irs thresholds have also been raised for next year, including. The standard deduction for income tax filings in 2025 will also be 5.4% higher.

10%, 12%, 22%, 24%, 32%, 35%, and a top bracket of 37%. Income up to $11,600 ($23,200 for married couples filing.

Tax payment Which states have no tax Marca, Tax brackets for different filing statuses, how the tax brackets really work, and most importantly, why your taxes could actually go. The federal income tax has seven tax rates in 2025:

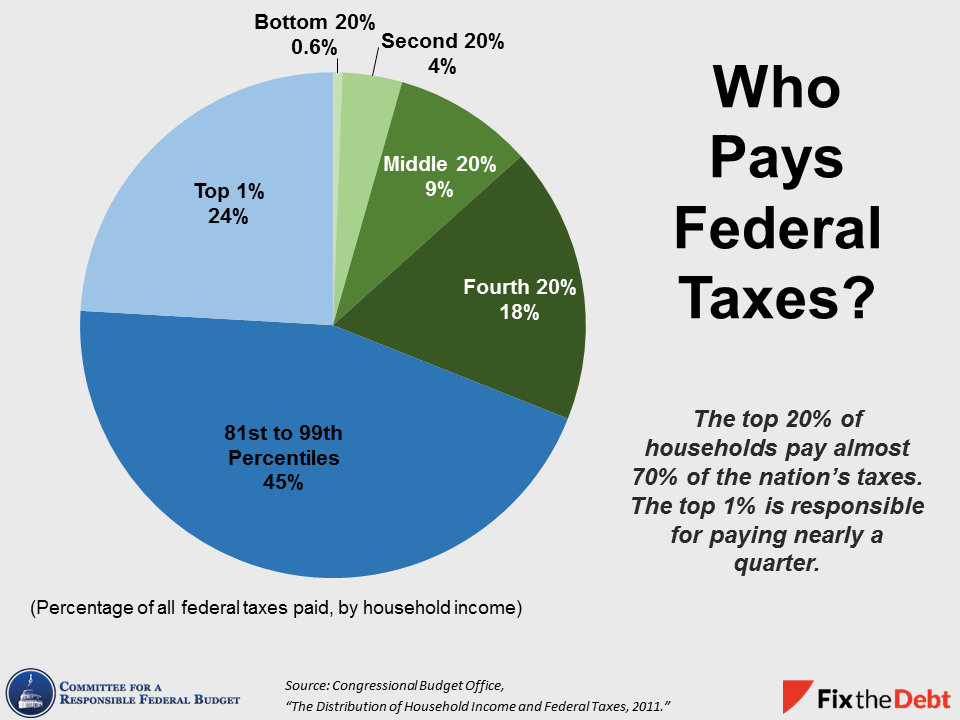

The rich pay a lot in taxes, The top tax rate remains 37% in. The changes the irs announced on thursday are for tax year 2025, for which returns will be due in april 2025.

When Did Tax Start? in 2025 tax, Mortgage loans,, The federal income tax has seven tax rates in 2025: The changes the irs announced on thursday are for tax year 2025, for which returns will be due in april 2025.

Will Tax Go Up For Families Making 80,000 Per Year? YouTube, Income up to $11,600 ($23,200 for married couples filing. For tax year 2025, each of the seven rates will apply to the following new income tax brackets:

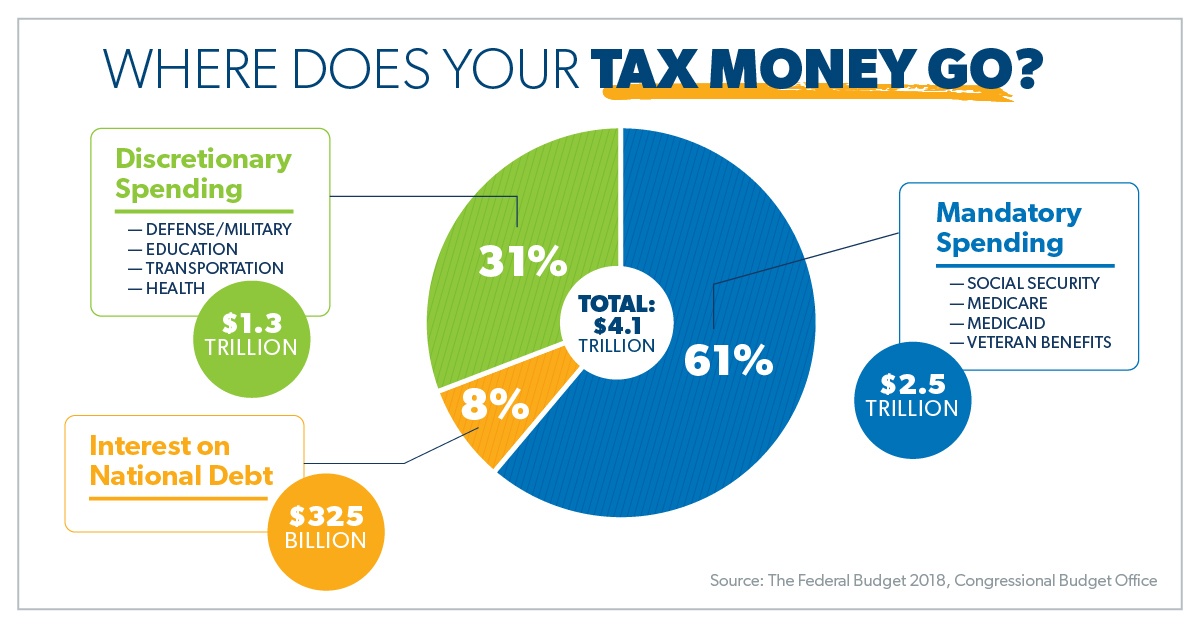

How Much Of Every Tax Dollar Goes To Military Spending Dollar Poster, Tax brackets for different filing statuses, how the tax brackets really work, and most importantly, why your taxes could actually go. The new year brings new tax brackets, deductions, and limits that will impact your 2025 federal income tax return.

National Insurance and dividend tax go up to pay for care, However, the income thresholds for all tax brackets. The irs is increasing the tax brackets by about 5.4% for both individual and married filers across the different income spectrums.

When did Tax Start? WorldAtlas, These updates to the tax code will go into effect for 2025 tax returns, meaning they will apply to taxes filed based on 2025 income. The irs is increasing the tax brackets by about 5.4% for both individual and married filers across the different income spectrums.

Did My Taxes Go Up? I Hadn’t Noticed., Changes coming in april 2025. For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers.

HOW TO HANDLE TAX SCRUTINY?, The irs is increasing the tax brackets by about 5.4% for both individual and married filers across the different income spectrums. Here's an overview of the 2025 u.s.

CBO's Analysis of the Distribution of Taxes Committee for a, Canada’s federal carbon tax will rise from $65 to $80 per tonne on april 1, 2025, increasing the carbon tax rate per litre of gas. The changes the irs announced on thursday are for tax year 2025, for which returns will be due in april 2025.